In the fast-paced world of cryptocurrency trading, emotions often take the driver's seat, steering market trends and influencing investor decisions. One tool that has gained significant attention for deciphering these emotional currents is the Crypto Fear and Greed Index. Originally inspired by CNN Money, this index has evolved to cater specifically to the volatile nature of the crypto market.

Understanding the Crypto Fear and Greed Index

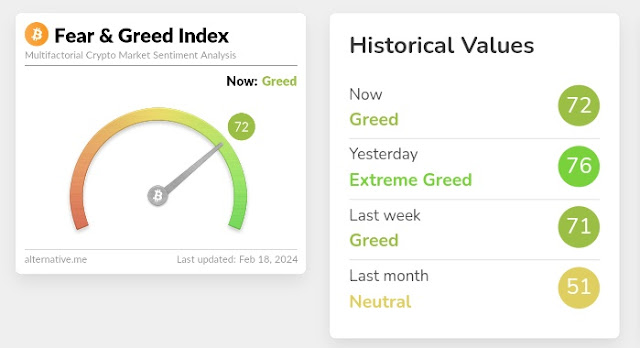

The Crypto Fear and Greed Index employ a diverse set of signals to assess market sentiment. Volatility, market momentum, social media activity, surveys, dominance, and Google Trends collectively contribute to the index's calculation. Each factor holds a specific weight, with volatility and market momentum accounting for 25% each, highlighting their significance in reflecting fear and greed.

Interpreting the Index for Trading Strategies

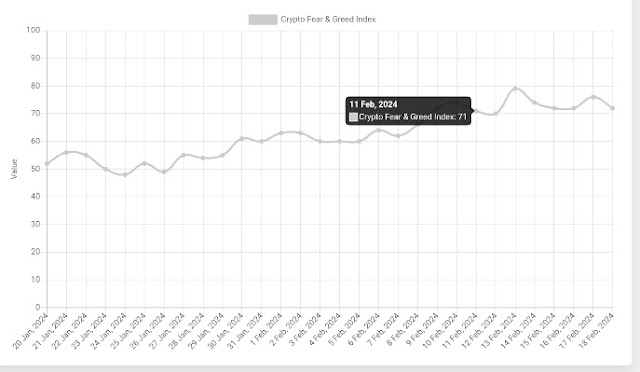

Trading in the crypto market requires a nuanced understanding of emotional reactions, particularly fear of missing out (FOMO) and greed. When the index is low, it may signal a potential upward market movement, presenting a buying or holding opportunity. Conversely, high index values may indicate overvaluation, prompting traders to consider selling or waiting for a dip to buy.

However, it's crucial to note that the index responds to short-term shifts rather than prolonged market growth. Traders often leverage it for short-term insights, using extreme fear as a potential buying opportunity and extreme greed as a signal for a possible correction.

Detecting Fear and Greed: A Trader's Compass

To effectively use the index, traders should keenly monitor shifts in sentiment. Increasing fear sentiments, as indicated by a decline in the index, may suggest a downward market trend. On the other hand, a rising index, particularly in the extreme greed zone, hints at an overly bullish market.

It's important to recognize that while the index provides valuable insights into market sentiment, it doesn't replace the need for thorough research and consideration of other indicators. Extreme fear or greed can sometimes precede unexpected market turns, catching unwary traders off guard.

Strategies to Control Emotions While Trading

Maintaining emotional control is paramount in crypto trading. Successful traders often adopt contrarian thinking, echoing Warren Buffett's advice to be cautious when others are greedy and vice versa. Dollar-cost averaging, diversifying portfolios, and adhering to a well-crafted trading plan are additional strategies to minimize emotional decision-making and navigate market volatility.

Conclusion: Striking a Balance for Trading Success

Thriving as a crypto trader involves finding the delicate balance between fear and greed. Crafting a solid trading plan, diversifying portfolios, and leveraging tools like the Crypto Fear and Greed Index contribute to a well-rounded approach. Reflecting on past trades through a trading journal becomes a roadmap for improvement, and staying informed with insights from seasoned investors like Warren Buffett and reputable sources like Coinbase adds valuable perspective to your trading journey. Remember, in the unpredictable world of crypto, balance is key when navigating the waves of price swings.

0 Comments

If you have any doubts, Please let me know.