Bitcoin's $4,000 Dip: A Blip or a Sign of Things to Come?

|

| Bitcoin's $4,000 Dive: A Prelude to a Bullish Surge or a Harbinger of Doom? |

|

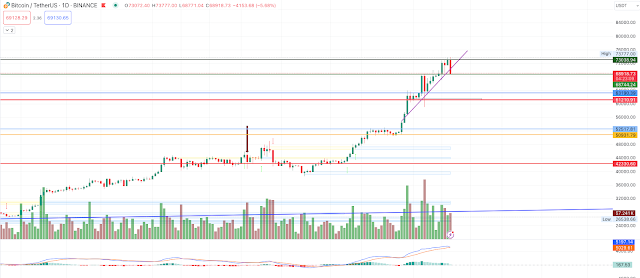

| Source: Trading View |

The influx of institutional interest continues to drive heavy buying activity in the Bitcoin market. Despite ongoing selling pressure from entities like the Grayscale ETF, the collective impact of nine Spot Bitcoin ETFs outweighs these concerns. Additionally, the anticipated reduction in Grayscale selling over time lends further support to the bullish sentiment surrounding Bitcoin.

Analyzing the price action of BTC, it's evident that the asset is respecting its upward trend line, with Tuesday's dip serving as a confirmation of support at previous all-time highs. With prices quickly rebounding above the uptrend line, the outlook appears positive, albeit with the possibility of further downward wicks that are likely to be swiftly bought up by eager buyers.

As discussions surrounding Bitcoin's price targets proliferate across social media, traders need to exercise caution and conduct their own analysis. While $100,000 and $150,000 are commonly cited targets, Fibonacci levels suggest potential milestones at $102,000 and $156,000, respectively.

In conclusion, while Bitcoin's recent dip may have caused a momentary pause, the broader trend remains overwhelmingly bullish. Traders should remain vigilant, mindful of potential volatility, and conduct thorough analysis before making any investment decisions. As always, this article serves as informational content and not as financial advice.

.png)

0 Comments

If you have any doubts, Please let me know.